eSocial – Mandatory from January 2018

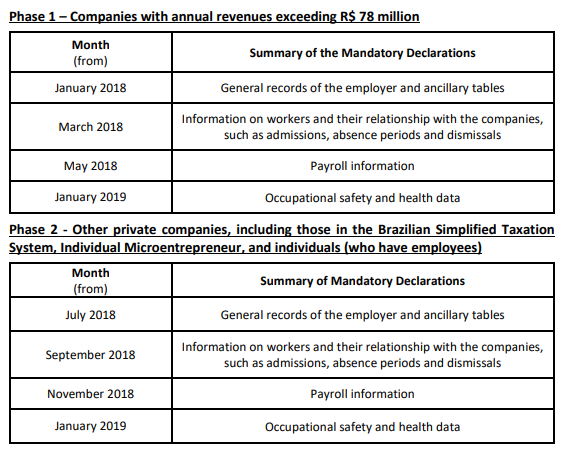

According to Resolution Nr. 3 of November 29, 2017, published by the Steering Committee of Digital Bookkeeping System of Tax, Social Security and Labor Obligations (eSocial), as of today, January 8, 20181, companies whose revenue, in 2016, exceeds R$ 78 million will be required to declare their labor, social security and tax information by means of the eSocial, according to the schedule below:

It should be further noted that Normative Instruction 1767/2017 of the Brazilian Federal Revenue Service establishes the form of compliance with certain ancillary obligations during the progressive implementation of eSocial.

Thus, companies must comply with the digital ancillary deadlines and obligations related to eSocial, subject to risks of tax and labor notices of violation for failure to comply with ancillary obligations, including the possibility of fines in accordance with the infraction practiced.

This newsletter contains information and general comments on legal matters that may interest our clients and friends. It does not represent the legal opinion of our firm on the subjects addressed herein. In specific cases, readers should rely on proper legal assistance before adopting any concrete action relating to the matters addressed herein.

For additional information on the matter, please contact:

Thiago Ramos Barbosa

Rodrigo Gonzaga de Oliveira