-

Isabel A. Bertoletti

-

José Maurício Machado

-

Júlio de Oliveira

-

Ana Lucia Marra

-

Antonio Carlos Harada

-

Daniel Lacasa Maya

-

Mirella da Costa Andreola

-

Renata Colafêmina

-

Rodrigo Forlani Lopes

-

André Affonso Amarante

-

Caio Fink Fernandes

-

Cristiane Tamy Herrera

-

Diego Soares

-

Diego Viscardi

-

Gabriel Nassar Lacerda

WTS Transfer Pricing Newsletter – October 2017

Luis Rogério Godinho Farinelli and Lúcio Breno P. Argentino signed the Brazilian chapter of the october edition of the WTS Transfer Pricing Newsletter:

Brazil’s Request to Join OECD: Changes to Local Transfer Pricing Rules?

After acting as a Key Partner of the Organisation for Economic Co-operation and Development (OECD) for approximately 10 years and taking part in several bodies, projects (such as the Base Erosion and Profit Shifting – BEPS project) and legal instruments over the years, Brazil presented a formal request to join the OECD on 29 May 2017.

If approved, the accession of Brazil as a member of the OECD could have a significant impact on the Brazilian transfer pricing rules in a few years. Widely known for its complex tax system, Brazil chose to adopt, as of 1997, transfer pricing rules inspired by the OECD Transfer Pricing Guidelines but mostly based on objective criteria.

Although the criteria adopted by Brazil has a relatively straightforward application, most often than not, Brazilian transfer pricing rules do not necessarily result in arm’s length prices due to use of predetermined profit margins (which can amount to 40% for certain activities).

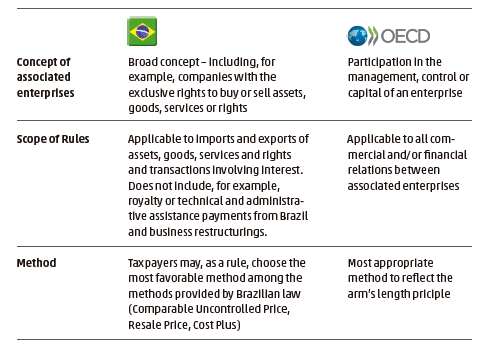

In addition to the use of fixed margins, Brazilian transfer pricing rules deviate from the OECD Transfer Pricing Guidelines in the following main aspects:

Although it is still uncertain as to whether the OECD will accept Brazil’s request to become a member of the organisation, if approved, the accession process could require a substantial change to Brazilian transfer pricing rules.

As evidenced above, the main challenges that Brazil could face to ensure the application of the arm’s length principle by Brazilian taxpayers could be the elimination of fixed profit margins under the Cost Plus and the Resale Price methods, the adoption of a comparability analysis, the application of the Transactional Net Margin and the Profit Split methods, the implementation of the master file provided under BEPS Action 13 and the adoption of the corresponding adjustments under Double Tax Treaties, among others.